Sole traders and partnerships are not separate legal entities from the owners. Different accounting entities have different financial reporting requirements. The purpose of the Sales Returns account is to track the reduction in the value of the revenue while preserving the original amount of sales revenue. This is a non-operating or “other” item resulting from the sale of an asset (other than inventory) for more than the amount shown in the company’s accounting records.

What is a Contra Revenue Account?

Permanent accounts are not closed at the end of the accounting year; their balances are automatically carried forward to the next accounting year. It is linked to specific accounts and is reported as reductions from these accounts. The allowance method of accounting allows a company to estimate what amount is reasonable to book into the contra account. The percentage of sales method assumes that the company cannot collect payment for a fixed percentage of goods or services that it has sold. The purpose of a contra account is to offset the balance of a related account. Contra accounts are an essential part of accounting that are often misunderstood or overlooked.

What is the difference between a contra account and a regular account?

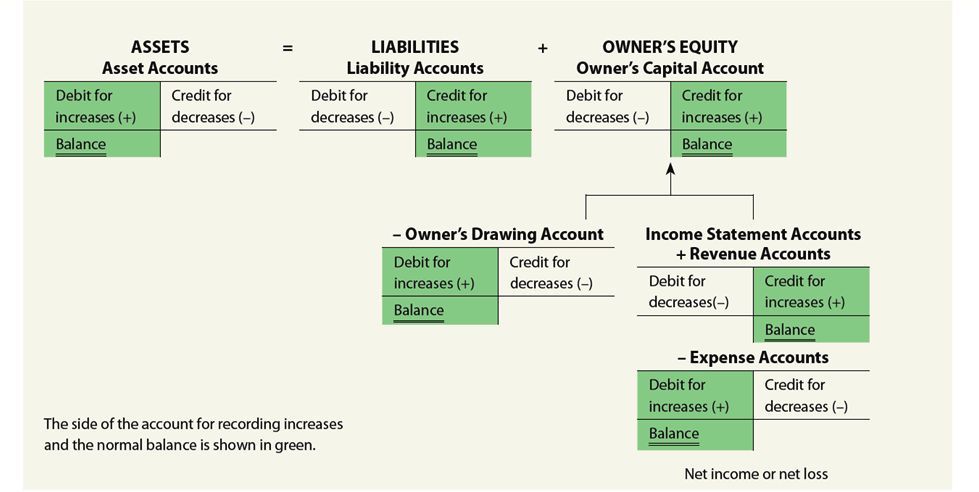

Because of the matching principle of accounting, revenues and expenses should be recorded in the period in which they are incurred. When a sale is made on account, revenue is recorded along with account receivable. Because there is an inherent risk that clients might default on payment, accounts receivable have to be recorded at net realizable value. Expenses normally have debit balances that are increased with a debit entry. Since expenses are usually increasing, think “debit” when expenses are incurred. Again, the company’s management will see the original amount of sales, the sales discounts, and the resulting net sales.

Is Unearned Revenue a Contra Account?

For companies in the business of lending money, Interest Revenues are reported in the operating section of the multiple-step income statement. Under the accrual basis of accounting, the Service Revenues account reports the fees earned by a company during the time period indicated in the heading of the income statement. Service Revenues is an operating revenue account and will appear at the beginning of the company’s income statement. As noted earlier, expenses are almost always debited, so we debit Wages Expense, increasing its account balance. Since your company did not yet pay its employees, the Cash account is not credited, instead, the credit is recorded in the liability account Wages Payable.

It represents the amount of discount that was given when the notes were issued. The purpose of this account is to increase the effective interest rate of the notes. Treasury stock is a contra equity account that is used to offset the balance of the common stock account. It represents the amount of stock that has been repurchased by the company. The purpose of this account is to reduce the total equity on the balance sheet. By using contra accounts, companies can provide a more accurate representation of their financial position in their financial statements.

A contra account is an account that is used to offset the balance of a related account on a company’s financial statements. For example, a contra account is used to offset the balance in a company’s accounts receivable account. When a customer makes a payment, the amount is credited to the accounts receivable account and debited to the cash account. Accumulated depreciation offsets a company’s real property assets, such as buildings, equipment and machinery. Accumulated deprecation represents the cumulative amount of depreciation expense charged against an asset.

A current asset account that reports the amount of future rent expense that was paid in advance of the rental period. The amount reported on the balance sheet is the amount that has not yet been used or expired as of the balance sheet date. Insurance Expense, Wages Expense, Advertising Expense, Interest Expense are expenses matched with the period of time in the heading of the income statement. Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid.

The gain is the difference between the proceeds from the sale and the carrying amount shown on the company’s books. This means that the new accounting year starts with no revenue amounts, no expense amounts, and no amount in the drawing account. A contra account is a type of account that is used to offset another account. It is a separate account that is linked to another account, and it is used to reflect the opposite of the balance in that account.

- The purpose of this account is to reduce the total equity on the balance sheet.

- Contra revenue accounts are used to offset the balance in a revenue account.

- Closing entries also set the balances of all temporary accounts (revenues, expenses, dividends) to zero for the next period.

The purpose of the Owner’s Withdrawal account is to track the amounts taken out of the business without impacting the balance of the original equity account. Accounts Receivable is an asset account and is increased with a debit; Service Revenues is increased with a credit. These accounts facilitate auditing and financial the usual balance in a contra-revenue account is a: analysis by providing a detailed breakdown of adjustments made during a specific accounting period. This information assists auditors, and financial analysts in evaluating a company’s financial performance and risk exposure. When the company pays the cost of having the flyer printed, a journal entry is done.

Since cash was paid out, the asset account Cash is credited and another account needs to be debited. Because the rent payment will be used up in the current period (the month of June) it is considered to be an expense, and Rent Expense is debited. If the payment was made on June 1 for a future month (for example, July) the debit would go to the asset account Prepaid Rent. However, that $1.4 billion is used to reduce the balance of gross accounts receivable.